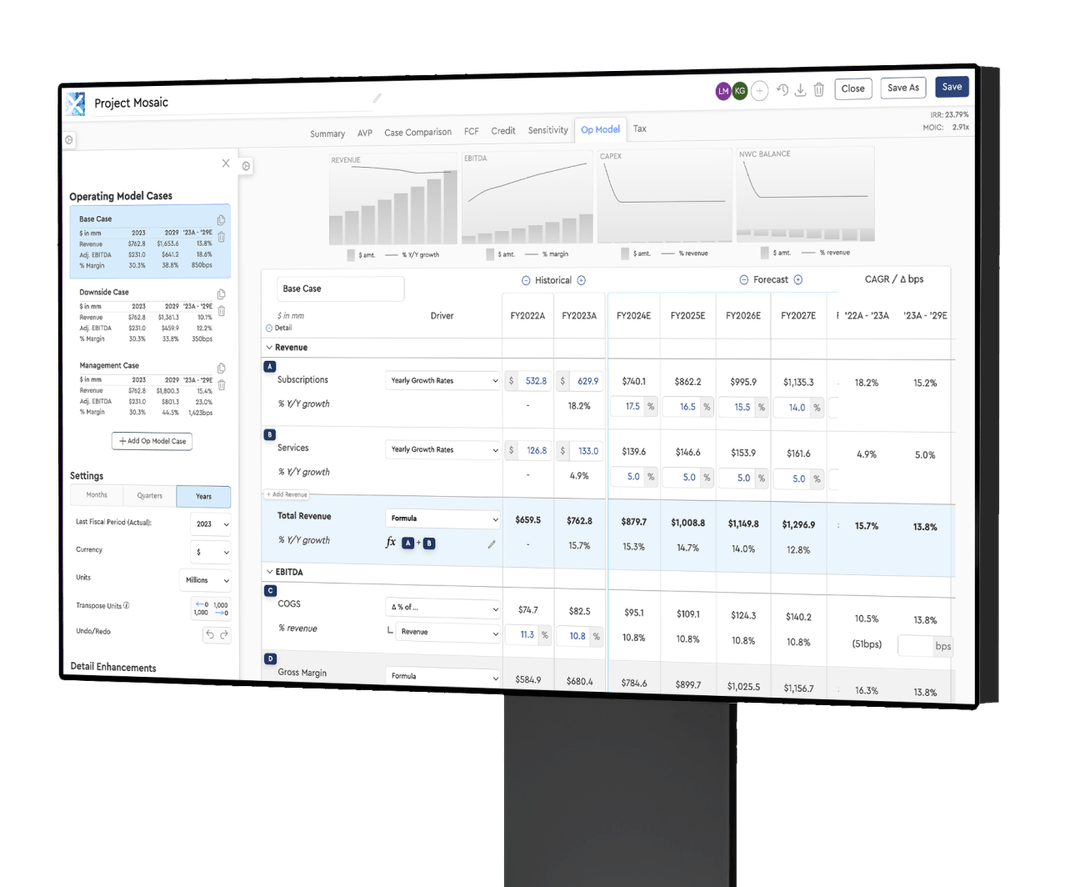

Screen New Opportunities

Understand “what you need to believe” in under 10 minutes for each top-of-funnel investment opportunity your team reviews.

Internalize the Range of Outcomes

Running Management's Case and a preliminary Base Case through a returns model should be a frictionless exercise conducted as early as possible. Form a view on value earlier in a deal process (i.e., "what you need to believe") and decide quickly if a deal hunts.

Thoughtfully Allocate Your Limited Time

The new deal funnel

Every investment firm has a funnel like this one. The volumes will differ, but the shape will be similar.

Whether you look at 10 or 10,000 deals a year, you likely only dive deep on a subset - and take fewer than 2% to the finish line.

Capture a view on value for your full funnel - saving you time and building institutional memory on each deal reviewed.

Increase your deal team's effective capacity

A home-run opportunity should never be missed because of tight staffing.

Increase your effective capacity by working smart at the start of the deal funnel.

Deal teams save significant time using Mosaic - time that can be repurposed to more value-added activities, including reviewing additional investment opportunities.

Reduce "rework" in error-prone manual modeling

Correct the first time, every time.

Avoid the wasted time, pain, and errors that come with starting from a “past deal” Excel template.

Mosaic's algorithm fires from a clean slate each time - making "legacy assumptions" (a.k.a. errors) a thing of the past.

Work in Excel whenever

All Mosaic models are downloadable into Excel with fully linked formulas and best-in-class financial modeling practices (e.g., color codes, no hardcodes in formula cells, print formatted, etc.).

That means (i) full transparency into how our math works and (ii) fully customizable additional output creation.