December 5, 2023 | 6 MIN. READ

Mosaic Deals Analytics™: Unlocking Insights Trapped in Spreadsheets

No leading private equity firm today would disagree that leveraging technology and embracing digital transformation at their portfolio companies creates value for their LPs.

Why do GPs and LPs care about digital transformation? Because it is a prerequisite to optimizing workflows. Moving manual, paper-based processes to purpose-built, cloud-native software applications reduces manual error and improves the productivity of valuable human capital – ultimately leading to lower costs and better investment outcomes.

Having worked in private equity for 6+ years prior to founding Mosaic, I was always perplexed that our industry rigorously applies this mentality towards our portfolio companies, but minimally towards the way we work within our own deal teams.

To me, the most glaring example was the core unit of analysis underpinning any new acquisition – the leveraged buyout model. I struggled to rationalize how the analyses supporting multi-billion-dollar investments were conducted in #REF’d out spreadsheets rolled forward from a previous deal’s template. It felt incongruous that I could complete my personal tax return in an intuitive digital application maintained by tax professionals, but the billion-dollar equity check my team was about to deploy was modeled in a generic spreadsheet program with a 24-year-old in the driver’s seat.

Building Mosaic was my solution – and since its founding three years ago, it’s become the world’s #1 Digital Deal Modeling™ platform, used by leading private equity firms who collectively manage over half a trillion dollars.

The core value proposition to-date has been time savings and error reduction for the deal team – the algorithm always fires the same way, meaning it can’t miss a step the way an exhausted deal team member can at 3AM the night before IC.

The ultimate benefit of digital transformation to enterprises, however, lies in the centralization and standardization of data created from the newly digitized workflow. It is the ability to instantaneously query thousands (or millions) of data points and gain insights from the proprietary work output we create over time.

It is this piece that can never be achieved in the status quo of disparate spreadsheets trapped in a labyrinth of folders on a shared drive.

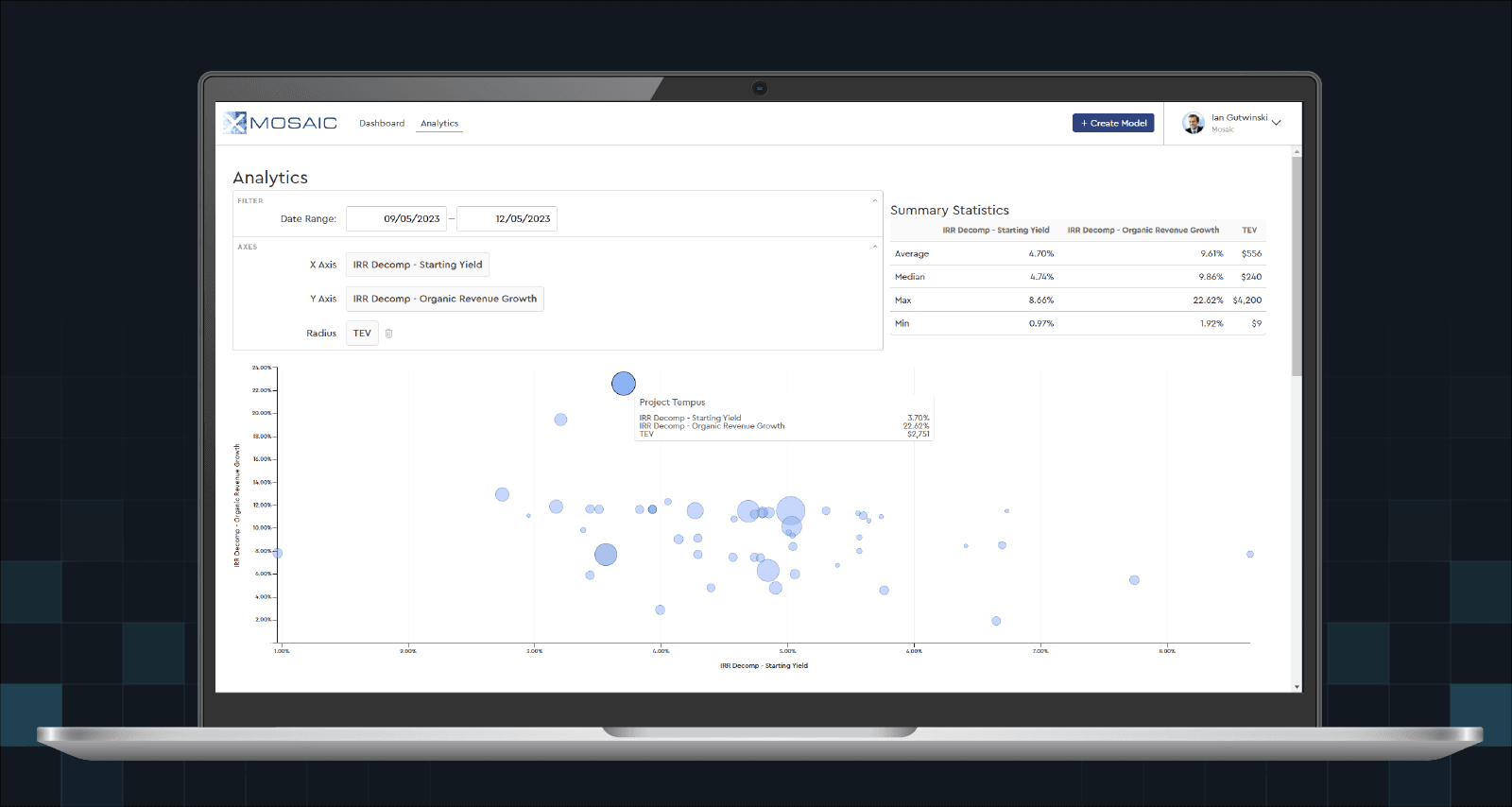

Today we’re unveiling Mosaic Deals Analytics™ – for the first time in the history of private equity, firms will be able to look across all deals underwritten in Mosaic for unparalleled insight, visibility, and comparability of key valuation and operational metrics.

With Mosaic Deals Analytics™ – our partner deal teams can now set a date range, pick the model assumptions or calculated outputs they are interested in, and in seconds query their full database of models across up to three variables in the same visualization:

Every single metric produced in Mosaic is calculated the same way for each model – ensuring perfect comparability across any number of deals reviewed in the platform.

For firms that have fully adopted Mosaic as their “single source of truth” for new deal underwriting, the elegance of their implementation lies in the fact that – unlike a CRM – no data entry is required outside of the deal team’s normal workflow. Firms don’t need to create Mosaic models because they hope one day to run analytics – instead, their deal teams simply build their bid models in the platform (in a more pleasant, efficient, and error-free way than status quo spreadsheets) all while building their firm’s institutional memory in a way that hasn’t been possible to-date.

Each data point represents a deal model that can be interacted with and quickly navigated to at the click of a button to explore the full leveraged buyout analysis without opening a shared folder or an Excel sheet.

Prior to Mosaic Deals Analytics™ – the work required for a GP to answer the question “what was the Unlevered Yield at entry for all the deals we looked at in 2023?” (perhaps in response to an LP data request) would be unbelievably burdensome.

Depending on the firm, it might look something like:

Allocate a member of the deal team to work on fulfilling the data request (i.e., take them away from doing deals).

The deal team member would need to then query the firm’s CRM (assuming one exists…) for the names of all projects created in the relevant period (assuming CRM records were in fact created for every deal…).

The deal team member would then need to search the shared drive for each deal, looking for a folder hopefully titled “Model”.

Within the folder, they would need to determine which of the 100+ versions is the one relevant to the analysis (vF? vFF? vCoinvest_Memo? vFinal_Memo?).

Within the spreadsheet, they would need to hunt for the cell that includes the Unlevered Yield at Entry – that is, assuming it exists. If it doesn’t, they’d need to calculate it for that model.

The data point would then be copied and likely hard-pasted into yet another spreadsheet that would contain the final analysis.

Steps 3-6 would need to be repeated for each deal the firm looked at in ’23. In 2024, if the request was made again, the full set of steps would need to be repeated – likely by a different deal team member with no prior experience fulfilling the request. There would also be no assurance that each model calculated Unlevered Yield the same way.

Mosaic Deals Analytics™ is now available for all our enterprise partners without any upgrade necessary (isn’t SaaS great?). Simply navigate to the Mosaic application and click on the “Analytics” tab on your home screen.

If your firm hasn’t yet armed your team with a Digital Deal Modeling platform and you’d like to try a better way of working – please do reach out. We’d love to show you why our partners say they can’t imagine working without Mosaic.

We would also love to hear from existing partners how they are leveraging this new Deals Analytics layer – whether it’s facilitating LP due diligence requests, reviewing the firm’s activity, comparing investments to one another – or other applications that we haven’t yet considered. Share your stories with us at info@mosaic.pe – we’d love to hear from you.