Overview

A common tool in private equity firms’ value creation toolkits is a focused, intentional cost savings or cost “take-out” plan. This topic is distinct from the kind of organic margin improvement that comes from operating leverage (i.e., when a business’s revenues grow faster than its costs, driving margin improvement).

A Cost Savings plan requires some combination of the private equity firm, the company’s management team, and a third-party consultant to thoroughly review the business’s operating costs by category to identify areas for potential excess cost.

When I worked in Private Equity, we would often hire leading consulting firms like West Monroe Partners, Alix Partners, Deloitte, or the Big-three (MBB) Management Consulting firms to help evaluate a cost savings opportunity for a new deal. These consultants have internal benchmarks for businesses operating in specific industries as to what “best-in-class” cost and margin profiles look like by key expense category.

We would often do complex “corporate carve-out” deals where we would purchase an orphaned division within a larger company and set it up as its own independent company. Lots of private equity firms do these deals and it can be lucrative – the 7th or 8th largest division in a publicly traded company likely won’t be getting as much scrutiny as its top three units – there simply isn’t enough time for management to focus on an area that won’t move the needle from them – so it is often the case that certain cost categories might stray from best-in-class benchmarks. Lots of value can be created by purchasing a business with excess costs (i.e., depressed EBITDA), right-sizing the cost structure, and then exiting the business years later with a more attractive margin profile.

What to Cut?

When thinking about cost savings opportunities, I always used to go line by line and ask myself – if the business no longer had access to the benefits associated with this expenditure, what would happen to the business? If the answer was “nothing at all” – there was a pretty good chance we found a savings opportunity.

3G Capital is famous for bringing “Zero-based-budgeting” into the PE lexicon. A sleepy way to set an expense budget for a fiscal period is to say “we spent $50 on marketing last year – should we keep it the same, spend a bit more, or spend a bit less based on our goals for the business this period relative to last?”

The zero-based approach in contrast asks each divisional budget owner to justify each dollar of spend from an opening assumption of zero dollars being spent on their expense items. Pretty hardcore.

This is where the cost savings exercise deviates from a pure benchmarking exercise. What’s necessary for one business may be entirely different than another, even within the same industry.

PE professionals often talk about cutting “fat” from a business – which would be those expenditures that wouldn’t impact the operations at all if cut tomorrow. Where a cost savings plan can go from value-creative to value-destructive is if you begin to cut muscle or bone – removing resources that are mission-critical to delivering your product or service to customers.

Common Cost Savings Areas

Reducing / repurposing real estate footprint. As WFH / hybrid workspaces continue to be more mainstream, the same amount of physical office space may no longer be required. High-cost downtown office space may be traded for lower cost suburban space closer to employees homes at lower rents, etc.

Renegotiating supplier agreements. Many smaller companies don’t have procurement teams that keep a close eye on supplier spend. Reviewing cost of commodity items and benchmarking them to industry standards could identify opportunities for savings. Firms like Blackstone have enduring scale advantages that allow them to pool their procurement scale across portfolio companies and simply pay less for the exact same services as a smaller, independent company could.

Cancelling unused software subscriptions. Reviewing software spend for “shelfware” (i.e., software subscriptions that no one is using) can identify opportunity for cost savings. Just like you’d cancel a streaming service you were no longer using – but if you’re not looking closely, those can accumulate quickly.

Outsourcing non-core tasks. Productivity gains from specialization is a fundamental economic concept. There may be workflows conducted in-house that can be more economically carried out by a third party while improving outcomes (e.g., customer support).

Eliminating redundant positions. As businesses grow and evolve, the human capital required to support the operations also evolves. If not re-evaluated on a regular basis, redundancy can accrue in the employee base. This is a topic that needs to be handled with utmost care, which we cover next.

Responsibilities of Private Equity when Actioning Cost Savings

The most important thing to consider and handle with care in these exercises is the treatment of personnel in a cost-saving exercise. In some situations, Private Equity has earned a reputation for ruthless cost savings plans that don’t appropriately consider the personal and societal cost of recklessly exiting employees from a business. It’s easy to look at a spreadsheet, compare a cost category to benchmarks, and run some rudimentary math to determine the reduction-in-force (“RIF”) necessary to get costs in line. It’s a much more involved exercise to make a decision human by human as to whether or not a position continues to add value to an operation. This is where the benchmarking exercise is less important, and a deep understanding of the business and each role’s contribution to the operation is required.

Businesses evolve, and individuals evolve – sometimes a role that made sense a decade ago in a business may not make sense today. In that case, it’s better for the business and the individual to part ways. What’s important is that the separation is handled with care and the individual is treated fairly with a transition support package, including a generous severance payment to amply bridge the gap between their last day with the company and their first day of their next role.

Most Private Equity firms today understand this inherent responsibility and conduct themselves accordingly. As individual investors / deal team members, I encourage you to approach any cost savings exercise and any personnel termination decision with the same care you would if it were a parent, sibling, or friend that you were dealing with – and not just a line on a spreadsheet.

Modeling Cost Savings

The following paragraphs and exhibits provide a framework for how to model Cost Savings from first principles, as well as a discussion on the rationale for each step. Follow these steps to build Cost Savings into a model outside of Mosaic (i.e., in Excel). For an Excel copy of the below analysis, reach out to your Mosaic Account Executive or sales@mosaic.pe.

A digital Cost Savings model is available in Mosaic under “Special Situations” to save you from needing to repeat these steps and reduce manual error. See our help article below on how to add Cost Savings to your Mosaic model:

Mosaic Special Situations | Cost Savings

A Cost Savings plan typically has two main elements that need to be reflected in a deal model:

Run-rate Cost Savings. This is the sum total of the costs identified as being redundant or unnecessary to run the business today and into the future. We refer to them as “run-rate” because they may take time to fully realize – this “run-rate” amount is the total amount of cost savings that will be realized once the reduction is fully actioned. You should think about this amount as the dollar improvement in EBITDA that a cost savings initiative will create. For example, a $40mm EBITDA business with a $10mm Run-Rate Cost Savings initiative can be thought of as having $50mm of “Pro-forma” EBITDA.

Cost to Achieve Cost Savings. Often times, the initiatives we take to action cost savings actually incur additional costs to take effect. You might logically be asking: why would you ever take on more costs to take out costs? The reason is simple: one-time vs. recurring. An example: let’s say we decide to replace a high rent Manhattan HQ with two new Queens and New Jersey offices to be closer to our employees homes. Leasehold improvements to the two new offices will cost us $1m. the Manhattan HQ Rent right now is $1mm per year, and the Queens and New Jersey offices will be $250K each instead. The annual cost savings here is $500K ($1mm - $250k - $250K) but the one-time cost to achieve these savings is $1mm. The key difference is that the savings persists year over year in perpetuity, whereas the cost to achieve is one-time. Another way to frame it – if this business sells for 10x EBITDA, this office relocation is worth $5mm to us (10x $500k) – while costing us only $1mm, or a 5x ROI.

As well as three other potential parameters to consider:

Cost-savings phase-in. This is the length of time, in years, that you expect it to take to achieve the full cost savings. Not all costs can be turned off immediately – some require a phased shut-off, and this assumption accommodates that.

Cost savings growth. Modeling Cost Savings is a deviation to an operating model case which includes those costs that you are cutting. If those modeled costs are growing – for example, with inflation – then your run-rate cost take-out assumption should also grow commensurately.

Cost-to-achieve phase-in. Not as common as Run-rate Cost-savings phase-in, but sometimes you may want to assume that your costs to achieve cost savings also are phased in. This assumption accommodates that scenario.

Desired Goal:

Incorporating Cost Savings into an LBO should increase IRR and MOIC by improving EBITDA (and therefore exit value if using an EBITDA multiple) at a greater quantum than incurring one-time costs to achieve.

The only way that a cost savings plan would not be accretive to IRR and MOIC would be if the one-time costs to achieve those savings were greater than the Enterprise Value enhancement those cost savings provide.

Cost Savings is a Model Extension in Mosaic and we will discuss its impact on the Six Core Schedules of the LBO covered in our foundational article on the Anatomy of the Deal Model.

Cost Savings plans impact the following schedules:

Step 0 – Cost Savings Assumptions

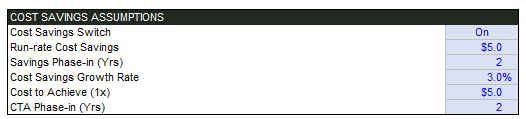

As with any deal modeling exercise, it’s helpful to start by setting up an assumptions bank that clearly separates your chosen inputs from the mechanics of the model itself. The key assumptions you need to make space for before building anything are:

Run-rate Cost Savings

Cost Savings Phase-in

Cost Savings Growth Rate

Cost to Achieve Cost Savings

Cost to Achieve Phase-in

Here’s an example of what the Cost Savings Assumptions bank looks like in Mosaic:

Step 1 – Layer Cost Savings into EBITDA

Impacts: OPERATING MODEL

The first and most impactful adjustment we must make to the deal model for cost savings is layering in the run-rate cost savings into our operating model.

In Mosaic, we create a new tab called a “Consolidated” tab which copies over the core lines of the operating model (i.e., Revenue, EBITDA, Capex, and NWC) and expands them for inorganic model extensions like M&A, cost savings plans, sale leasebacks, etc.

If you’re building a simple model with one operating case and cost savings, you can layer this directly into your operating model. Mosaic supports multiple operating cases (e.g., upside, downside, base, management case, etc.) which necessitates an additional consolidated tab to layer on inorganic model extensions.

Let’s add a line for the cost savings impact to EBITDA. This line will need to model out not only the run-rate impact, but also any phase-in period and like-for-like growth rate that we’ve assumed for the cost savings.

Below is a GIF illustrating the formula we apply for layering in cost savings:

Step 2 – Cost to Achieve Cost Savings

Impacts: FREE CASH FLOW

The Cost to Achieve Cost Savings (“CTA”) must also be reflected in our deal model – however, this is a non-recurring cost type and thus does not impact EBITDA or the operating model. As such, we reflect CTA in the cash flow statement to ensure that we are appropriately burdening our cash flows with the one-time cost (i.e., it reduces the cash available to pay down debt, etc.).

Again, below we show a GIF to reflect how we layer the CTA into the model, including the optional phase-in for the CTA assumption.